SEO Gush

Insights and updates on the ever-evolving world of SEO.

The Curious Case of Trade Reversal Timelines in CS2

Uncover the secrets behind trade reversal timelines in CS2! Explore surprising insights that could change your approach to the game.

Understanding Trade Reversal Timelines in CS2: A Comprehensive Guide

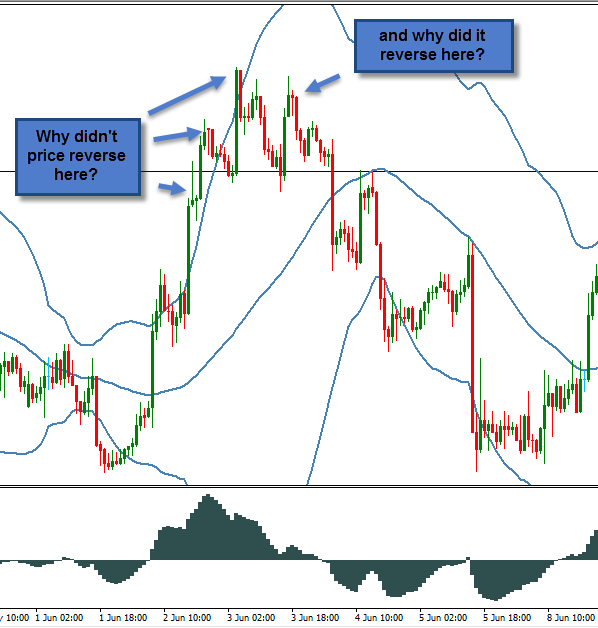

Understanding trade reversal timelines in CS2 can significantly impact your trading strategy and overall success. In this comprehensive guide, we will explore the factors that determine these timelines, including market conditions, player activity, and trading volume. Knowing the right time to execute a trade can prevent potential losses and maximize your profits. Moreover, we will delve into the various types of trades and how their reversal timelines can vary, ensuring you have the necessary knowledge to make informed decisions.

To effectively navigate the complexities of trade reversal timelines, traders should consider keeping a close eye on significant market signals. For instance, technical analysis tools can provide insights into trends and reversals, while following community discussions and expert opinions can help identify impending changes. Additionally, it is essential to implement a systematic approach that includes analyzing historical data and case studies of previous trades. By adopting these methods, you can enhance your understanding and become proficient in recognizing when to act for optimal trading outcomes.

Counter-Strike is a highly popular first-person shooter game that has become a staple in competitive gaming. Players engage in team-based combat, with one team typically taking on the role of terrorists and the other as counter-terrorists. For those interested in the trading aspects of the game, you can learn how to reverse trade cs2 to enhance your gameplay experience.

What Factors Influence Trade Reversal Timelines in CS2?

Understanding what factors influence trade reversal timelines in CS2 is crucial for players aiming to enhance their gameplay and strategy. One of the primary factors is the market volatility, which can fluctuate based on player demand and supply dynamics. When the demand for a certain weapon or skin increases, the timelines for trade reversals can be significantly affected, pushing players to adapt quickly. Furthermore, external events like game updates or seasonal promotions can lead to sudden shifts in the market, altering traditional reversal patterns.

Another significant aspect is the player behavior and the community trends. The psychology of traders plays a large role in determining when to execute trades, as players often make decisions based on peer actions or popular trends. A sudden influx of new players may result in a surge of transactions, which in turn could impact how swiftly trades are reversed. Understanding these nuances can provide a competitive edge in CS2 trading, allowing players to anticipate market shifts and act accordingly.

The Implications of Delayed Trade Reversals in CS2: A Detailed Analysis

The world of esports, particularly in games like Counter-Strike 2 (CS2), is constantly evolving, and understanding the implications of delayed trade reversals is crucial for both players and analysts alike. Delayed trade reversals can significantly affect team strategies, player morale, and financial outcomes in competitive matches. These situations occur when a player fails to secure a trade execution following an engagement, leaving their team vulnerable to counterattacks. Over time, these reversals create a ripple effect, altering team dynamics and potentially affecting ranking positions in tournaments.

Moreover, the fallout from delayed trade reversals often extends beyond immediate match results, impacting long-term team development and player retention. Teams that frequently experience these issues may find themselves re-evaluating their tactical approaches, player roles, and even their training regimens to mitigate future discrepancies. The analysis of past games to identify patterns and formulate strategies to overcome such challenges can be an invaluable tool for coaches and analysts aiming to enhance team performance. In conclusion, addressing the root causes of delayed trade reversals in CS2 is essential for maintaining competitive integrity and fostering growth in the esports ecosystem.